In Dynamic Planner, everything seamlessly connects, so your organisation has efficient control over a more engaging and customer-focused financial planning process, one which delivers a consistent customer experience across multiple touchpoints, from what they view on their screen, to analysis they read in communications and reporting.

Dynamic Planner may be synonymous with out-of-the-box, financial planning technology. But today, through its Open API, it can powerfully integrate to meet your organisation’s exacting needs. To create an integration, Dynamic Planner’s Technical Solutions team will work closely with you to make the process quicker, simpler and more agile. Integrations can pinpoint specific parts of Dynamic Planner, which are most relevant to your organisation.

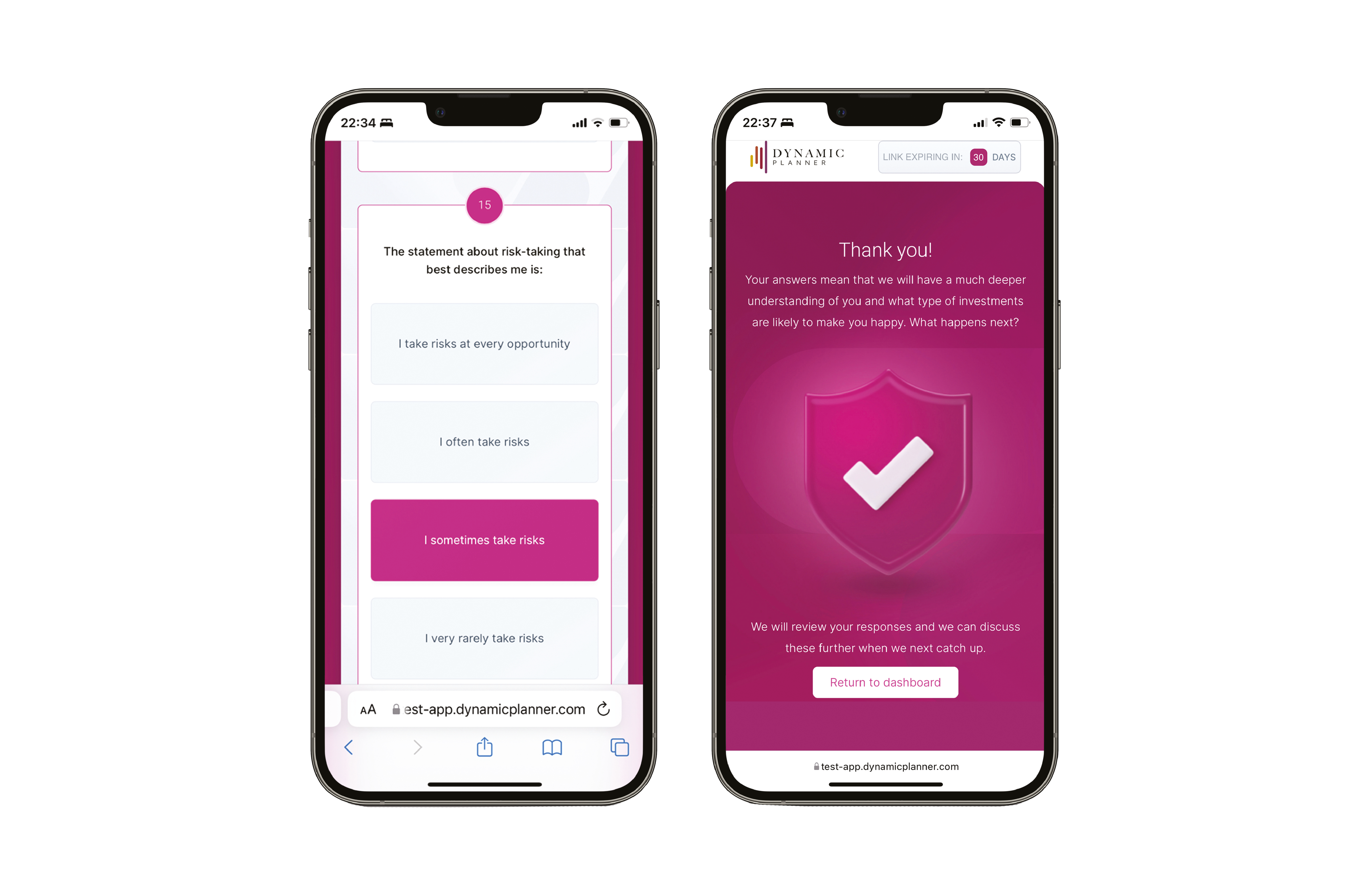

Dynamic Planner never stands still. It is constantly evolving and innovating to keep pace with change, both in financial services and with rising customer expectations around technology. Today, in Dynamic Planner, a client can be a more active partner in the financial planning process, enabling them to self-serve in many ways and in a virtuous circle, making them more attractive to you as a potential customer.