Dynamic Planner Investment Committee – Q1 2020 Update

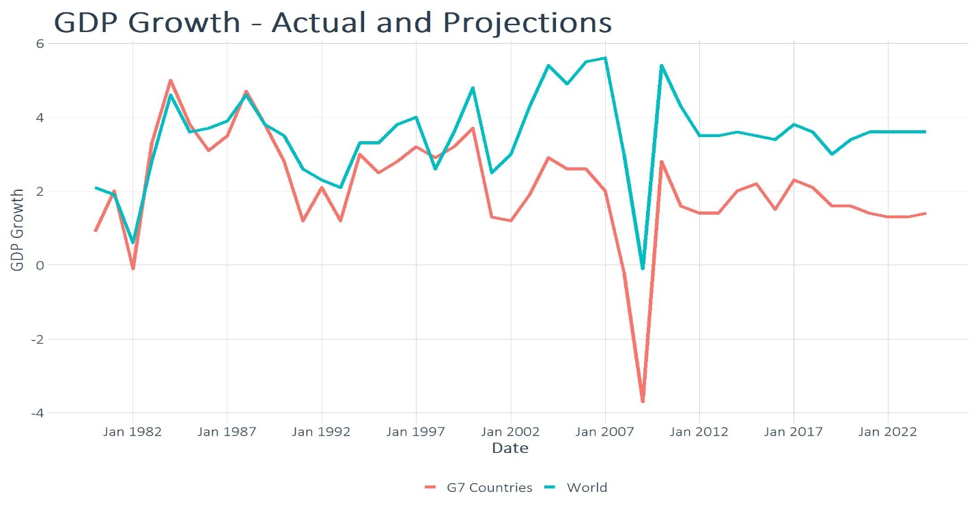

Global growth levels were muted for 2019, but forecasts are for a modest pick-up in 2020 for the G7 economies.

The US still stands out among the advanced economies, given the current full employment and strong retail sales growth. With 2020 being an election year, there have been hints from the Federal Reserve of letting the economy ‘run hot’ rather than raise rates again. The previous three rate cuts had certainly improved market sentiment over 2019, but further cuts this year are being viewed as unlikely.

The Euro Zone (mainly Germany) is re-adjusting to weaker demand globally and has seen consumer confidence fall, resulting in muted growth.

Emerging markets and the Asia Pacific region still remain the powerhouse of global growth, but structurally we expect this to temper, especially in China, because of the growing trend to repatriate manufacturing back onshore by the developed economies as a result of technological advances. The spread of the coronavirus is also a growing existential threat to the expected growth levels in China as well as to the wider global economy.

In the UK, we have finally got closure over the Brexit divorce and the resulting ‘Boris bounce’ in consumer confidence after the resounding general election result in December. However, several big challenges await during the future UK – EU trade relationship negotiations this year.

We are expecting generally muted growth in 2020, with focus mainly centred on the impact on world trade negotiations and the potential lowering of tariffs, rather than further monetary policy initiatives. While talks between the two largest global economies, China and the US, will continue to hold centre stage, we could see more fiscal stimulus measures elsewhere to revive economic growth fortunes, particularly in Japan, UK and Europe.

The US, as we have already mentioned, still stands out among advanced economies, but expansionary monetary policy may have less than expected impact on growth at current levels of employment and consumer confidence. The growth rate in China will continue to slow.

Inflation will remain subdued, in spite of continuing loose monetary policy across the globe.

The current macroeconomic backdrop all points to a continued ‘Risk On’ approach throughout 2020, but with levels of negative yielding debt estimated at $12 trillion (albeit down from its peak of $17 trillion), as a result of ultra-loose central bank monetary policy, there are many reasons to remain aware of the downside risks should policy or external events suddenly change

The degree of the impact of the coronavirus on global growth is still difficult to predict at this stage and also, we have the US presidential race this year, so one can expect President Trump will be doing all he can to get re-elected.

As a result, the Dynamic Planner Investment Committee felt at this time no changes to the current risk profile asset allocations were warranted and the strategic theme of maintaining a globally diversified portfolio with reducing exposure to bond duration continues.

Find out more about Dynamic Planner fund research