Jim Henning – Head of Investment Services at Dynamic Planner – outlines the current climate and confusion around the labelling of sustainable investing solutions. In step with COP26, regulatory pace has been gathering in the UK in 2021. But how will new measures, aimed at asset managers, help advice firms and their clients? Plus, with investors’ sustainability preferences too being discussed, what can firms do now to prepare?

Broadly, what problem is the industry facing around solution labels for sustainable investing?

The fundamental problem of course is mankind being on a ‘code red’ warning, because of catastrophic consequences of climate change, and time is running out fast to do something about it.

As we have seen during COP26, this is a global problem, which requires global solutions on an unprecedented scale. The whole financial sector has a crucial and urgent role to play in reorienting capital flows towards a more sustainable global economy, if we are to have any hope in slowing down the rate of global warming.

However, defining what ‘sustainable’ actually means has always been the problem. Opinions vary; self-disclosed company data can be patchy and without external scrutiny; while of course science and regulation continually evolves.

The encouraging news is that global regulators and governments have been busy trying to get agreement for concerted action in setting clear and measurable targets and a comprehensive and common baseline of sustainability disclosures applying to businesses as well as asset managers.

Among the intense media coverage during COP26, HM Government showcased its ‘Greening Finance: A Roadmap to Sustainable Investing’, which will apply to UK listed businesses, including the financial services sector as well as investment products.

It included ambitious plans for reporting environmental impact using the UK’s own version of a Green Taxonomy, which provides an essential reference point for companies to report against and timescales on additional broader sustainability disclosures, referred to as SDR. Also, in recognition of the key role of retail advice within the investment chain, there can be no surprise it will be brought into the scope of this regulatory framework, subject to industry consultation.

Using this framework, the FCA recently issued a discussion paper ‘Sustainability Disclosure Requirements and investment labels’ which, following the consultation process, is likely to bring about improved clarity when categorising funds. The paper floats the concept of four potential fund type labels and how their underlying holdings are aligned to the Green Taxonomy of business activities:

- Not promoted as sustainable

- Responsible and Sustainable ‘Transitioning’

- Sustainable ‘Aligned’

- Sustainable ‘Impact’

Asset managers/owners and investment products will be required to substantiate ESG claims they make in a way that is comparable between products and is accessible to clients and consumers.

They will also need to disclose whether and how they take ESG-related matters into account in their governance arrangements at overall entity level, which will be useful additional information for the first two fund categories above and vital that a wider range of businesses are also encouraged to a greener transition pathway.

‘Drive now towards sustainable investment is unstoppable’

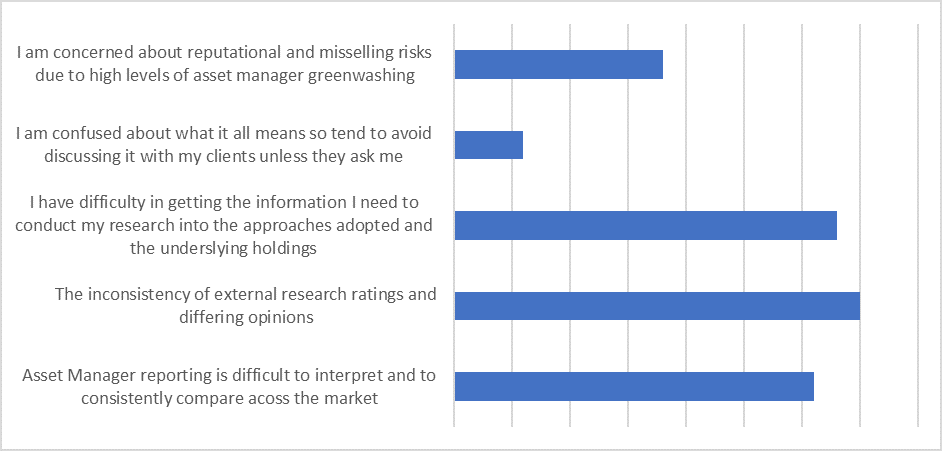

We know the barriers that many advice firms who use Dynamic Planner are currently facing in incorporating sustainability within their process. The graph below illustrates responses to an online poll conducted at a sustainability webinar we held for firms this October.

The drive towards sustainable investment is now unstoppable and these new regulations aim to help demystify some of the confusion felt by advice firms, improve the clarity of fund disclosures and increase trust in the sustainable outcomes claimed. While the UK regulator chose not to incorporate EU regulations for client sustainability assessment last year due to Brexit, the intention now is clearly for advice firms to do so.

What can advice firms do today, to get ready for regulation?

While these global initiatives are vital, they are very much focused around the provision of improved disclosures and objectivity of data reporting. However, what can’t be codified is how to measure individual preferences around sustainability, which must be based on discussions with clients. Approaches here clearly depend on individual circumstances.

There is a place for detailed, factually based questionnaires for those clients who are interested in aligning their portfolios with their personal values or religious beliefs. However, for the majority, bringing out those unique preferences in a more engaging way without bias could really help cement the future relationship.

Our sustainability preference questionnaire comprises 15 questions and has been developed using rigorous psychometric and statistical based techniques, to accurately predict these preferences. It offers a repeatable and structured framework to enable further client discussions within the wider suitability assessment process.

There is really no reason to delay trying out the sustainability questionnaire and marrying it with Dynamic Planner’s risk questionnaires, so you can properly demonstrate a ‘client profile’ assessment within your process.

What about ESG fund research?

Industry and regulatory efforts to improve clarity will no doubt shift the dial, but this will both take time and evolve. Dynamic Planner’s sustainability questionnaire uses five categories of investor preference, ranging from ‘low’ to ‘very high’ importance and can be used with any form of additional fund research as the follow-on step in the process.

In Dynamic Planner, you can also access ESG fund ratings and reports from MSCI, providing your firm with institutional grade research across the wide market of funds [hear from Naomi English, MSCI’s Head of ESG Product Strategy].

The good news is that the majority of formally risk profiled multi-asset solutions, in Dynamic Planner, have strong ESG credentials according to the MSCI research, meaning that your existing panel of funds may already be meeting the sustainability preferences of many of your clients.

Download our guide to sustainable investing and share with your clients, in support of your conversations