A client whose financial adviser had relied upon performance scenarios required in a Key Information Document (KID) at the start of this year, may have been unprepared for this year’s coronavirus crisis.

The same could also potentially be said if their adviser relied upon past performance of an IA sector to highlight potential returns in future – or made simplifying assumptions like ‘market recovers within 1yr’.

Such techniques are employed by advisers while, of greater concern, the performance scenario approach required in KID’s – which already applies to Packaged Retail Investment and Insurance-Based Products (PRIIPs) – is expected to be applied to all UCITs funds from the end of 2021.

The 2020 coronavirus crisis will cast a spotlight on the use of historically based performance statistics as a guide to future risks and returns.

Problems with historic performance

For fund managers, the Summary Risk Indicator (SRI) required in a KID and the associated performance indicators are calculated using five-year historic performance data as the key determinant.

While the SRI requires the use of value-at-risk analysis, taking into consideration a probabilistic distribution of potential returns and losses, the dispersion of returns during this year’s crisis underlines how sweeping a categorisation this is and why it is problematic to prepare clients for their investment journey using it.

Reviewing the range of UCITs funds, which have their current risk indicator score calculated at 3 (from a maximum range of 7), yields an array of 16 IA sectors with well over 200 primary funds – equity, mixed asset or bond-oriented, with the latter including local currency emerging market debt funds.

The situation worsens when reviewing the forward-looking performance scenarios required on a KID. Looking at a popular, volatility managed, multi-asset fund with an SRI of 3 out of 7, an ‘Unfavourable’ outcome reveals the investor might be expected to only lose 1.48% after a four years and further, can expect to enjoy a positive return over the holding period of seven years of 1.18%.

‘Moderate’ and ‘Favourable’ forecasts, meanwhile, project persuasive growth figures over these time frames.

The classic criticism of this approach is well documented and arguably well deserved. As Deloitte has put it previously: “For many funds, bullish market conditions in recent years may result in overly optimistic projections. Trends may be exaggerated in case they are projected over long investment horizons, as very positive past performance is assumed to continue indefinitely and the potential cyclical nature of markets is not taken into account.”

Crises like 2020 can happen

For investment advisers, reliance upon historic IA sectors performance to explain potential risks and returns does not work either. The range of outcomes in a single fund sector is often so wide as to be meaningless in terms of expectation setting for a client’s portfolio.

Assuming a sector’s performance history will continue to repeat itself is of course simply wrong. Adopting this approach, for example, at the beginning of this year would have believed a crisis like Covid-19 could not happen.

Relying on deterministic projections to help clients plan for the future and risk match portfolios only introduces more limitations – and even if they are married with ‘market crash’ and recovery assumptions, because these ‘crashes’ too rely in main on historical data.

The emergence of contemporary asset allocation-driven portfolio construction and financial planning tools echoes thinking that, according to research, more than 90% of the variability of returns of a typical portfolio is explained by asset allocation.

A progressive, more robust answer

Progressive models, in comparison, adopt a combination of historical inputs – returns, volatility and asset class correlations – alongside inputs reflecting prevailing conditions, like inflation, bond yield spreads and forward-looking expectations for global growth and dividend pay-outs.

These inputs are then fed into an asset model, which assumes a distribution of returns, the extremes of which may not have been experienced yet and can only be seen in ‘tail risk’ events.

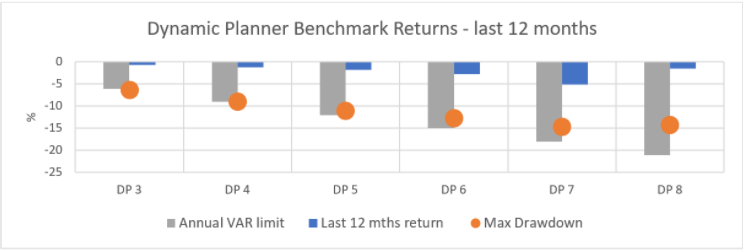

Our experience at Dynamic Planner, so far in 2020, is that this provides a more robust approach for managers and advisers to construct and plan portfolios. The graph below shows the observed performance of the Dynamic Planner – MSCI benchmarks over the last year, against their expected value at risk (calculated at a 95% confidence limit) alongside the maximum drawdown experienced.

This value at risk statistic is used with the client during the risk profiling process, so the adviser can be sure it is a consistent basis for matching the portfolio and there is no risk of ‘miscalibration’, as the FCA describes it.

The use of asset allocation-driven, forward-looking models, to assess potential returns and losses for clients, has been growing rapidly since 2008 and the global financial crisis. They represent not just an improved mechanism for projecting and for setting investor expectations, but also for matching them to investments that are more likely to perform within these expectations in a way that is fair, clear and not misleading.

They greatly improve upon historical or deterministic models and mean clients sat with their advisers don’t look back in anger while planning a bright future.

Find out how Dynamic Planner’s Asset Risk Model could help your firm.