In a landscape today defined by good consumer outcomes, Dynamic Planner is home to the institutional-quality research your firm can trust. It provides you with the greatest confidence and accuracy when matching clients with suitable investment solutions. It digs deeper, underpinning recommendations you make with meticulous rigour.

Research is delivered by Dynamic Planner’s in-house and independent team, who are focused on looking beyond a top-level view of asset allocation, which, like the tip of an iceberg, can fail to reveal hidden and potentially harmful risks.

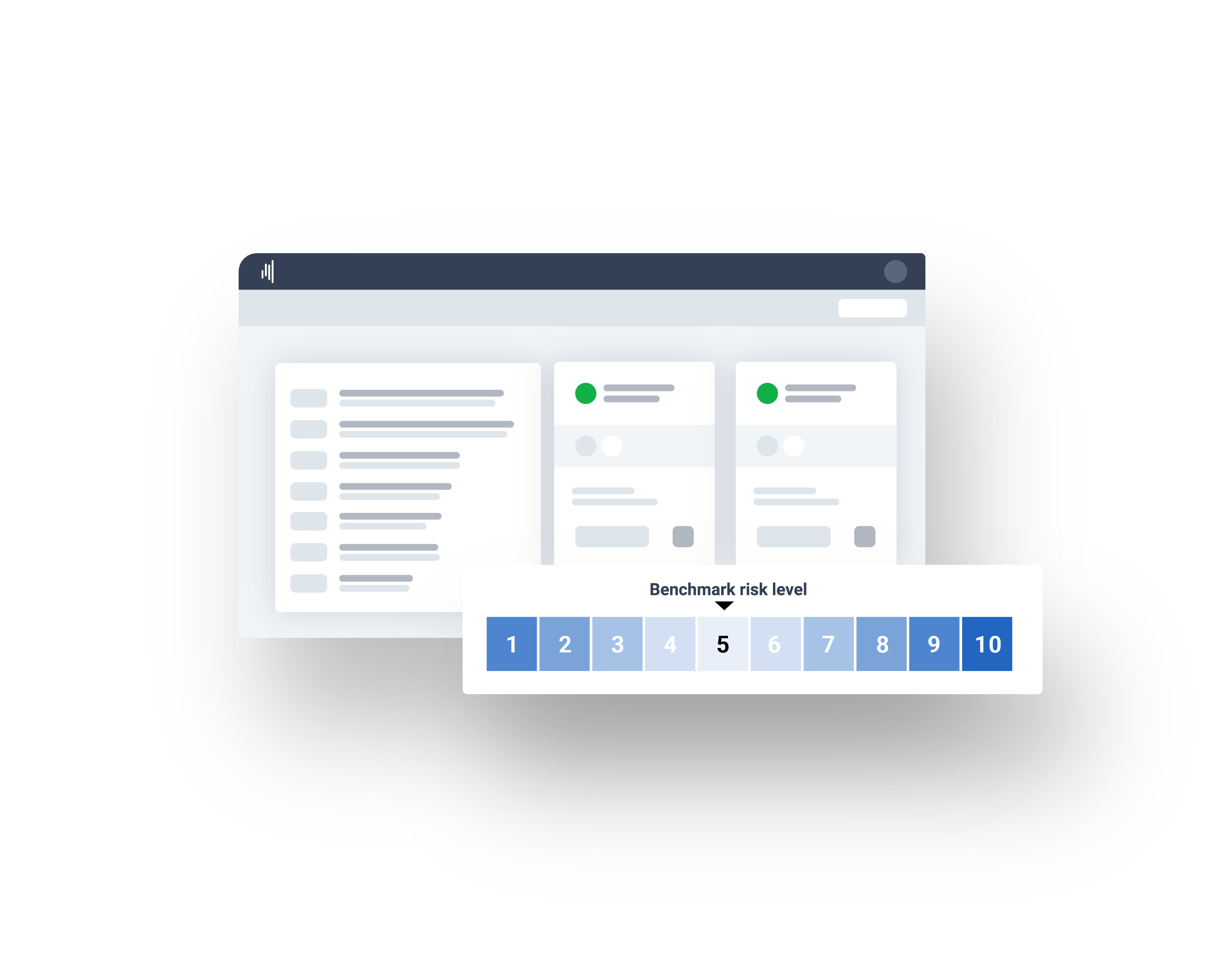

Dynamic Planner’s risk analysis is uniquely robust, drilling into a solution’s underlying holdings, which are shared directly by the fund’s manager, and provide you with a granular assessment of its risk in relation to Dynamic Planner’s 72 asset class asset risk model. The correlations and covariances of each holding are carefully unpacked to reach a final risk profile for a solution.

Whether you recommend to your clients multi-asset, discretionary MPS, or build your own model portfolios, you can trust deeply in Dynamic Planner’s institutional-grade analysis.