Read time: 5min

Something nearly always has to give in life. Unfortunately, for UK advice firms in the wake of increasing industry regulation, it appears to be their profit.

“We speak to firms all the time and anecdotally we hear that the demand for their services has never been greater and that they are doing very well, with revenue going up in the right direction,” said Mike Barrett, Consulting Director at financial services consultancy The Lang Cat. “However, the profit that these firms are generating is going the other way.”

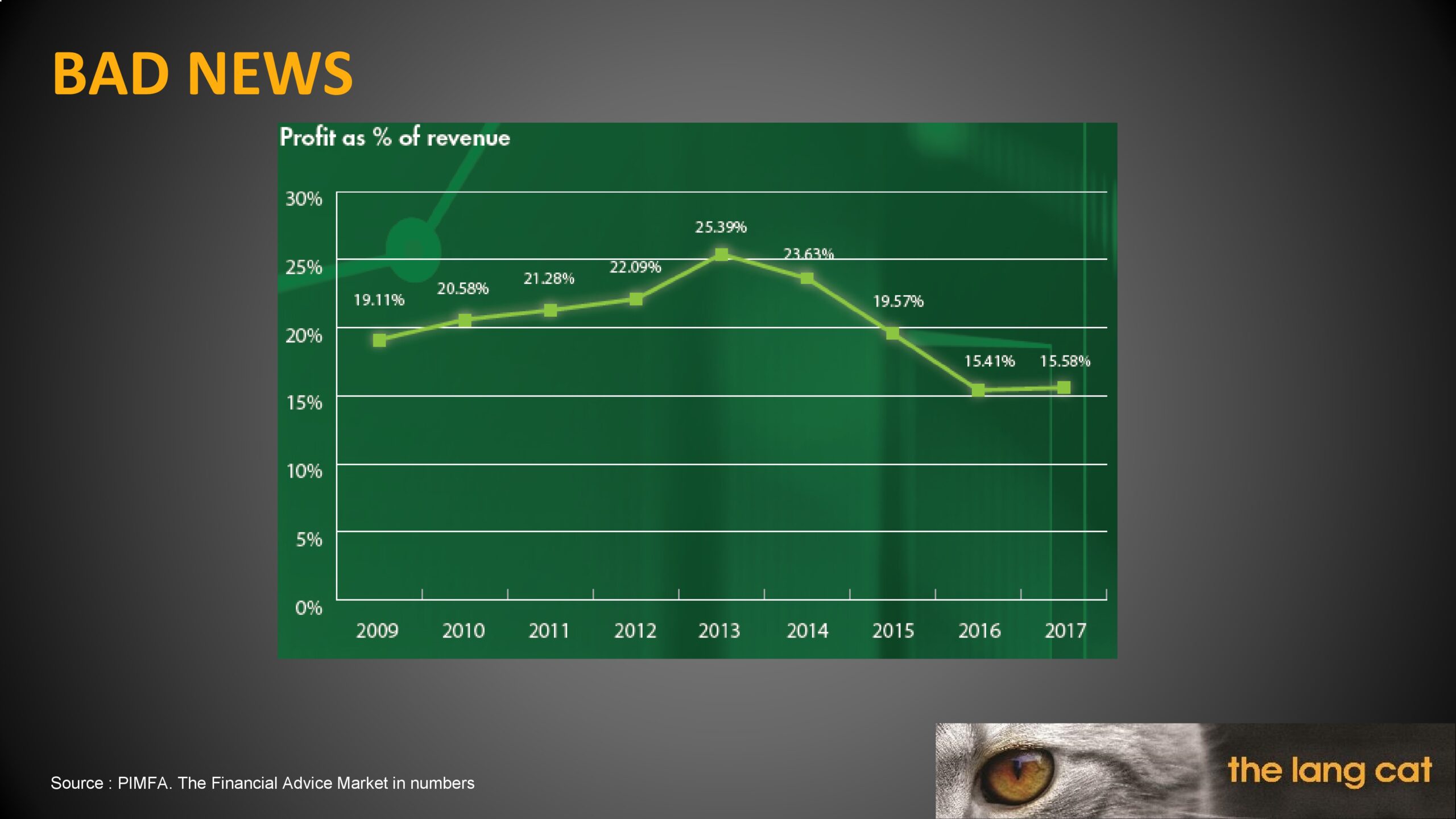

Research from the Personal Investment Management and Financial Advice Association (PIMFA) identifies that in 2013 profit as a percentage of revenue for firms on average stood at more than 25 per cent. However, four short years later in 2017, that figure had starkly dropped to just over 15 per cent.

“We don’t know exactly what is driving that,” Mike Barrett continued. “But our perception is that it is regulatory cost. Firms today are not as efficient as they should be.”

Mike Barrett was speaking at a private press launch – for industry journalists – in London for the Dynamic Planner Client Review, which we were excited to launch at the beginning of June.

He delivered a short presentation to the room, but which was packed full of fantastic insight, research and hugely informed opinion on the problems most pressing for advice firms today, 18 months on from the introduction of MiFID II regulation.

It was a timely overlap of ideas. Our new Client Review has been produced directly in response to feedback we received when we asked firms 18 months ago, ‘What work worries keep you awake at night?’

Investment suitability for their clients around MiFID II – was their resounding answer.

“This is the role technology can play,” said Mike Barrett. “Firms are pretty confident when it comes to their customer proposition, but it’s about improving their service proposition – helping clients understand complexities when they have to and ultimately making firms more efficient.”

Mike Barrett continued: “In a previous life, if you had wanted to change a client out of a particular fund, you would have simply emailed, saying, ‘I would like to change you out of fund A to fund B for these reasons’. The client replies. The adviser makes the fund switch. Job done.

“MiFID now, however, has taken the legs away from that proposition.

“Instead of sending an email, the adviser has to complete a suitability report, a benefit analysis and send the client various documentation. It might not be the quantity of that documentation which is the killer for firms, but the fact that it has to all be personalised – and there has to be an assessment around that as well.”

The new Dynamic Planner Client Review dramatically reduces the time it takes for firms to complete reviews for clients.

“It’s saving us a tremendous amount of time – and I mean hours and hours per client,” said Nick Ryan of advice firm Yellow Bear Financial Consultancy, which has been trialling it since January 2019. “Dynamic Planner is way ahead of the pack with this.”

Chris Miller of advice firm Miller Associates added: “It’s a new document for a new process, which, because of MiFID II, advisers have to produce and go through now. Dynamic Planner is ahead of the game in financial services, making this available.”

Mike Barrett: “It’s no longer simply mail merging and blind copying in 20 clients. Every client must have a report around their objectives and an assessment has to be completed on top of that. If you have a large number of clients, MiFID has made that previous way of implementing your proposition unsustainable.”

The average age of a client in the UK today seeking advice is 57, Mike Barrett highlighted in his presentation. The average case size for a client is £150,000.

For people on the high street with less than that, but who are still keen to invest, securing professional advice from a firm might be difficult because, ultimately, serving them has become unprofitable, bringing us back to where we began.

On the flip side of the coin, more of us today would perhaps benefit significantly from sound professional financial advice.

The recent rise of the ‘slashie’ – or people who class themselves as having more than one job title – married to the fact that all of us can expect to experience more varied careers, which accumulate more than one pension, has seen to that.

“You can almost imagine a typical new client now walking into an advice firm, with a nice bag full of stuff saying, ‘Here you go financial planner. Here’s all the stuff I have accumulated over my life – all of my pensions – please sort it out’,” said Mike Barrett.

“The average age a millennial now can expect to inherit wealth is 60, 61 – so, soon, not only will a client have objectives concerning their own children, but they will have inter-generational wealth as well. So, yes, you do need good, professional financial planning to sort all of that out.”

The new Dynamic Planner Client Review has been 18 months in development and built in partnership with advice firms.

More than 100 firms were part of a special Early Adopter Programme we set up to help manage and encourage more granular feedback once advisers, paraplanners and administrators were able to use the Client Review in their everyday working practices.

That opportunity and collaborative way of working certainly appealed with advisers and was genuinely appreciated. The end result, either way, today is a service and software which is only more closely wedded to firms’ true needs.

Lee Whiteside of advice firm Plan4Life: “Quite often, companies will tick along and take your money each month, but there’s no new developments as such. With Dynamic Planner, it’s nice to see a company taking an active part in trying to help advisers.”

Mike Barrett: “The main challenge firms face today is, ‘How do I serve more clients?’ They have no issue getting more clients – they just want to do it more efficiently.”

- We couldn’t have put it better ourselves: How one adviser described our new Client Review