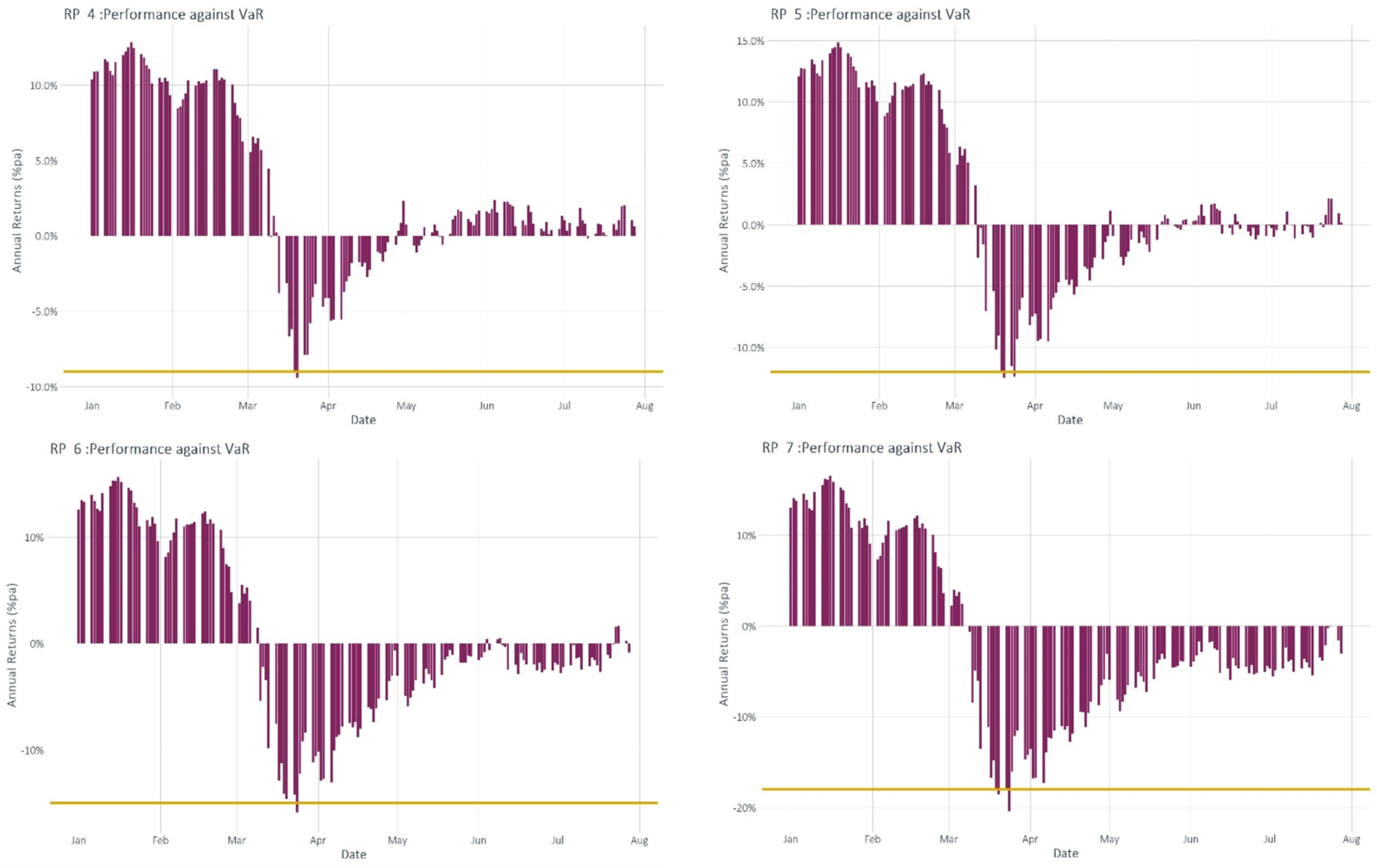

The Investment Committee reviewed the performance of the benchmark asset allocations and noted their great resilience in weathering the extreme market turmoil post the Covid outbreak, with all staying within, or very close to, their expected annual Value at Risk (VAR) limits.

The benefits of portfolio diversification provided by Dynamic Planner’s Asset Risk Model can be illustrated by the level of annual drawdown the benchmarks have experienced over these unprecedented times.

The one-year returns are compared to their respective expected VAR, within a 95% confidence limit, as represented by the horizontal line in the charts below. The benchmarks are calculated by MSCI [Morgan Stanley Capital International] and include quarterly rebalancing.

Navigating cross currents

- Uncertainty over the extent of lockdown measures and the nature of the eventual economic recovery prevails. In the absence of a vaccine, bolstering consumer confidence remains the priority for the post-lockdown world, but rising fears of the growing second wave of infections is beginning to see the re-imposition of stricter social distancing measures.With sentiment so fragile, any prolonged economic weakness could lead to increasing defaults from over-indebted corporates and the vicious cycle of increasing unemployment. However, there is an important distinction between the ‘run on the banks’ witnessed in 2008, to the ‘run to the banks’ to borrow this time round, as banks have significantly shored up their balance sheets.All eyes will be focused on how and when furlough measures will be adapted and tapered, as they must eventually have to be, given the eyewatering levels of debt / GDP that many economies are now having to grapple with.

- Interest rates are at rock bottom and if they remain ‘lower for longer’ or even ‘lower forever’ is an open question.Whether this macro demand-led shock leads to a long-term macro ‘regime change’, with the possibility of negative interest rates and deflation across developed economies, cannot be ruled out at this stage. However, low interest rates and excessive monetary stimulus must normalize at some point.In the case of the UK, the ballooning debt overhang, coupled with potential supply side inflation as a result of a no-deal Brexit and further weakening of the pound, could plausibly result in interest rate increases becoming necessary.

- From a valuation perspective, global bonds appear extremely overvalued after the extent of central bank intervention, with around 20% of issuance now in negative yield territory in nominal terms.Given the recent strong market bounce, global equity valuations also appear stretched and considerable uncertainty prevails around economic forecasts and corporate profitability. Existing business models are coming under increased scrutiny, with the market already signalling the potential winners (e.g. the tech and healthcare sectors) and the losers (such as retail, transport and energy).

- Given this unprecedented backdrop, ‘volatility of volatility’ will be an ongoing major concern for investors and can be expected to manifest itself in periods of heightened spikes.

Dynamic Planner Annual Asset Allocation Review – Key themes

During the annual review process, the Investment Committee agreed that the long-term strategic themes of building out further global diversification and a reduction from bonds into equities should gradually continue. The revised allocations – that went live in Dynamic Planner on 24 September 2020 – include:

- Further reduction in UK equities and an increase to US equities

- Reduced allocation into Sterling Corporate Bonds being exchanged for an increase in Global Investment Grade Bonds

- Recentralisation within expected risk boundaries being required. This involved marginal changes for the equity exposures being applied to the higher risk benchmark allocations

What’s the latest market and economic analysis? Read ‘Depression to euphoria’, by Abhi Chatterjee, Dynamic Planner Chief Investment Strategist